Social Security Disability Insurance (SSDI) 2025 marks a pivotal year for individuals seeking financial support due to disabilities. With evolving eligibility criteria and application processes, understanding the nuances of SSDI can significantly impact the lives of beneficiaries. As we delve into the essential aspects of SSDI, we will uncover the necessary documentation, potential policy changes, and the interplay between SSDI and other forms of insurance.

This exploration will also highlight the financial and social implications of SSDI, offering insights on how beneficiaries can maximize their support while navigating additional insurance options.

Understanding Social Security Disability Insurance (SSDI) in 2025

Social Security Disability Insurance (SSDI) plays a crucial role for individuals unable to work due to severe disabilities. As we look towards 2025, understanding the eligibility criteria, application processes, and potential policy changes is essential for those seeking assistance. This information will empower individuals to navigate the complexities of SSDI effectively.

Eligibility Criteria for SSDI in 2025

To qualify for SSDI in 2025, applicants must meet specific criteria set by the Social Security Administration (SSA). These requirements are critical in determining who can receive benefits. Below are the primary eligibility criteria:

- Work History: Applicants must have a sufficient work history, having paid Social Security taxes for a specific number of years. Generally, you need to have at least 20 quarters of work in the last 10 years, although younger workers may qualify with fewer quarters.

- Medical Condition: The applicant must have a medical condition that meets the SSA’s definition of disability. This means the condition must significantly limit one’s ability to perform basic work activities.

- Duration of Disability: The disability must be expected to last at least 12 months or result in death. This requirement emphasizes the severity and long-term nature of the disability.

Application Process for SSDI and Necessary Documentation

The SSDI application process in 2025 involves several steps that require careful preparation and documentation. Properly completing this process can greatly influence the speed and success of the application. Here are the key stages and necessary documents:

- Gathering Documentation: Applicants must compile important documents, including their Social Security number, birth certificate, medical records, and information about their work history. Accurate and comprehensive documentation is vital for a successful application.

- Filling Out the Application: Applications can be completed online, via phone, or in person at a local SSA office. The application requires detailed information about the applicant’s medical condition, work, and personal history.

- Submitting the Application: After completing the application and ensuring all documents are included, it can be submitted through the chosen method. Maintaining copies of all submitted materials is advisable for personal records.

Potential Changes in SSDI Policies Expected in 2025

As SSDI continues to evolve, potential changes in policies may impact eligibility and benefits in

2025. Keeping abreast of these changes is essential for current and prospective beneficiaries. Below are some anticipated developments

- Increased Funding: There may be discussions around increasing funding for SSDI to address the growing number of disability claims, influenced by demographics such as aging populations.

- Streamlined Application Processes: Efforts to streamline the application process could be implemented, aiming for faster decision-making and reduced waiting times for applicants. This might involve enhanced technology and improved training for SSA personnel.

- Policy Revisions: Ongoing evaluations of the disability determination process could lead to policy revisions, potentially expanding the criteria for qualifying conditions or adjusting the definition of disability to better reflect modern medical understanding.

Interrelation of SSDI with Other Insurance Types

Understanding the interrelation between Social Security Disability Insurance (SSDI) and other types of insurance is vital for beneficiaries to make informed financial decisions. This relationship can significantly impact the overall well-being of individuals receiving SSDI benefits. By examining how SSDI interacts with dental insurance, health insurance, and flood insurance, it becomes clear how these various forms of coverage can coexist and complement each other.

Comparison of SSDI with Dental Insurance

Dental insurance primarily covers oral health needs, such as routine checkups, cleanings, and specific treatments like fillings and surgeries. In contrast, SSDI is designed to provide financial assistance to individuals who are unable to work due to a disability. While both types of insurance serve important roles, their coverage implications differ significantly. SSDI does not cover dental expenses, and beneficiaries may need separate dental insurance to manage oral health costs.The importance of understanding this distinction lies in the financial planning required for those on SSDI.

Beneficiaries often need to consider additional expenses related to their dental care. While SSDI can provide a safety net for essential living costs, dental insurance can help manage health-related expenses that SSDI does not address. Thus, a comprehensive insurance strategy may involve maintaining both SSDI and dental insurance to ensure complete coverage.

Coexistence of SSDI Benefits with Health Insurance Coverage

Health insurance plays a critical role for SSDI beneficiaries, as it can provide coverage for medical services that SSDI does not directly address. Having health insurance can alleviate the financial burden of healthcare costs associated with chronic conditions or disabilities. The coexistence of SSDI benefits and health insurance allows individuals to access necessary medical treatments, medications, and therapies that support their ongoing health.Here are key points regarding this coexistence:

- Health insurance can cover primary and preventive care, which SSDI does not provide.

- Medicare becomes available to SSDI beneficiaries after 24 months, providing additional healthcare coverage.

- Private health insurance can help cover out-of-pocket costs not fully reimbursed by SSDI, such as copays or deductibles.

The collaboration between SSDI and health insurance enables beneficiaries to maintain a higher quality of life and manage their health conditions effectively. This synergy is crucial for long-term wellness, as it ensures that both financial support and necessary healthcare services are accessible.

Impact of Flood Insurance on Individuals Receiving SSDI

Flood insurance serves a unique purpose for individuals receiving SSDI, particularly those living in flood-prone areas. It provides financial protection against property damage caused by flooding, which can be particularly devastating for those with disabilities who may have limited financial resources. The presence of flood insurance can alleviate potential financial stress by covering the costs of repairs and recovery following a flood event.Understanding how flood insurance interacts with SSDI is essential for beneficiaries living in vulnerable regions.

Here are critical aspects to consider:

- Flood insurance can help protect the home, a crucial asset for individuals dependent on SSDI income.

- Damage from flooding can lead to unexpected expenses that may not be manageable on a fixed income, making flood insurance a vital safety net.

- Without flood insurance, SSDI beneficiaries may face severe financial hardship due to unanticipated natural disasters.

The impact of flood insurance on SSDI recipients underscores the importance of comprehensive risk management strategies that encompass all potential threats to financial stability.

Financial and Social Implications of SSDI in 2025

In 2025, Social Security Disability Insurance (SSDI) continues to play a crucial role in providing financial support to individuals unable to work due to disabilities. The program not only offers monetary assistance but also has significant social implications that affect the lives of beneficiaries and their families.Financial support from SSDI is designed to help individuals maintain a basic standard of living.

Beneficiaries receive monthly payments that can significantly ease financial burdens, allowing them to cover essential expenses such as housing, food, and healthcare. As of 2025, the average monthly SSDI benefit is approximately $1,300, although this amount can vary based on an individual’s work history and earnings prior to becoming disabled. This financial support is essential for those who may lack other sources of income.

Impact of SSDI on Social Situations

The influence of SSDI extends beyond finances, shaping the overall social dynamics for beneficiaries. The assistance received through SSDI can enhance individuals’ social situations in several ways:

Financial security fosters independence, reducing the reliance on family and community resources.

1. Improved Quality of Life

Beneficiaries can afford necessary services, such as transportation or home modifications, which can enhance their quality of life and promote greater independence.

2. Social Inclusion

With financial support, individuals are less likely to be isolated and can engage more actively in their communities, maintaining relationships and participating in social activities.

3. Mental Health Benefits

The stability provided by SSDI can alleviate stress and anxiety related to financial insecurity, contributing positively to mental health and overall well-being.To maximize benefits from SSDI while considering additional insurance options, individuals should be aware of several strategies:

1. Understand Eligibility and Benefits

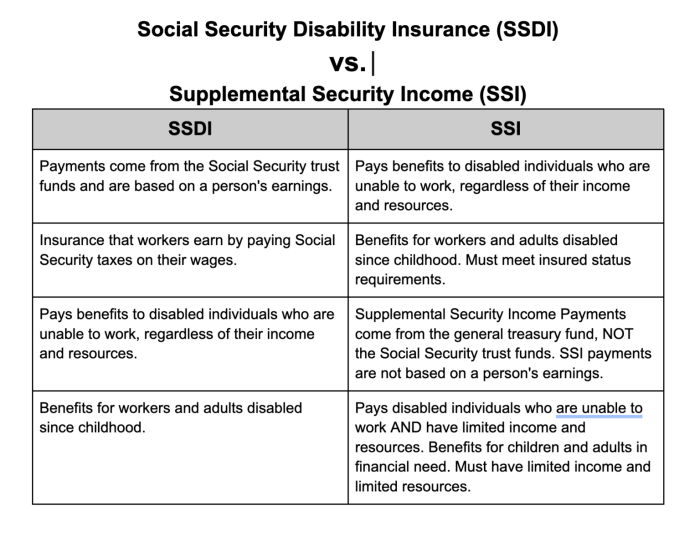

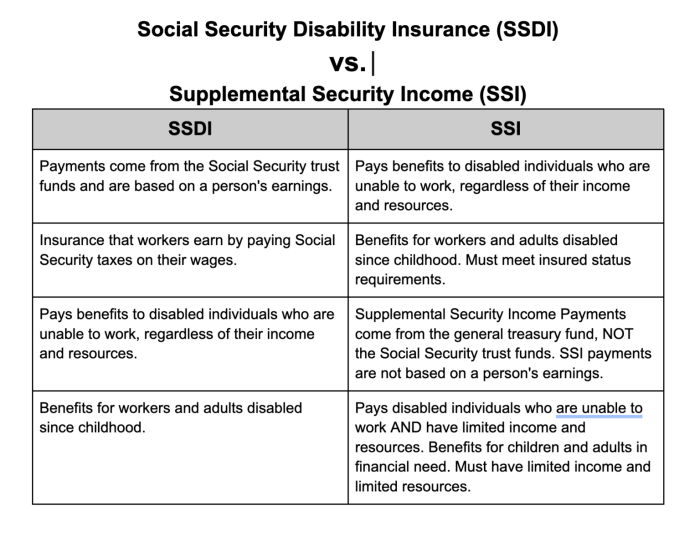

It is crucial to gain a comprehensive understanding of how SSDI benefits are calculated and what additional benefits may be available through Supplemental Security Income (SSI) or other state programs.

2. Explore Work Incentives

SSDI includes work incentives that allow beneficiaries to test their ability to work without losing their benefits entirely. Programs like the Ticket to Work program enable individuals to seek employment while still receiving support.

3. Research Private Insurance Options

In some cases, obtaining additional private disability insurance can supplement SSDI payments and provide a more robust financial safety net. It’s important to evaluate the terms and conditions of these policies to ensure compatibility with SSDI benefits.By navigating these aspects thoughtfully, individuals can enhance their financial stability and improve their social circumstances, making the most of the support that SSDI provides in 2025.

Final Thoughts

In summary, Social Security Disability Insurance (SSDI) 2025 presents both challenges and opportunities for those in need of support. By understanding eligibility, the application process, and how SSDI interacts with other insurance types, individuals can better navigate their circumstances. As we look to the future, staying informed about policy changes and benefit maximization strategies will empower beneficiaries to secure the assistance they deserve.

FAQ Insights

What is the eligibility criteria for SSDI in 2025?

To qualify for SSDI in 2025, individuals must demonstrate a significant disability that impacts their ability to work, along with having sufficient work credits earned through prior employment.

What documents are needed to apply for SSDI?

Applicants typically need to provide proof of identity, medical records, work history, and financial information to support their SSDI application.

Can SSDI benefits be combined with other insurance types?

Yes, SSDI benefits can coexist with other insurance, such as health insurance, but the interactions may vary depending on policy specifics.

Will there be any changes to SSDI policies in 2025?

Potential changes in SSDI policies for 2025 may include adjustments to eligibility criteria and benefit amounts, reflecting economic conditions and legislative updates.

How can beneficiaries maximize their SSDI benefits?

Beneficiaries can maximize their SSDI benefits by understanding their eligibility, keeping detailed records of their medical condition, and exploring supplementary insurance options to enhance financial support.