Dental coverage for children plays a critical role not just in maintaining bright smiles but also in ensuring their overall health. From routine check-ups to necessary treatments, having the right insurance can make a significant difference in a child’s development. Parents often overlook the profound impact that oral health has on a child’s physical well-being and confidence, making it vital to understand the importance of dental coverage.

This coverage not only addresses common dental issues faced by children, such as cavities and misalignments but also supports preventive care, which can save families from costly procedures in the long run. Understanding the different types of plans available and their unique benefits empowers parents to make informed decisions about their children’s dental health.

Importance of Dental Coverage for Children

Dental coverage for children plays a crucial role in promoting their overall health and well-being. It not only ensures that children receive necessary dental care but also fosters healthy habits from an early age. Access to dental services can prevent future dental issues, reducing the need for more extensive treatments later in life. By having dental insurance, parents can ensure that their children’s dental needs are met without the stress of financial burden.Having dental coverage significantly impacts a child’s overall health by addressing potential oral problems before they escalate.

Regular dental visits allow for early detection and treatment of issues like cavities, gum disease, and misalignment of teeth. Poor dental health can lead to serious health complications, including infections that may affect other areas of the body. Furthermore, children with healthy teeth are more likely to eat a balanced diet, speak clearly, and maintain self-esteem.

Common Dental Issues Faced by Children

A variety of dental issues can affect children, making dental coverage essential for their health. These include:

- Cavities: One of the most common issues among children, cavities can lead to pain and require fillings if not addressed early on. Dental coverage helps in managing the costs associated with fillings and preventive care.

- Misalignment: Many children experience misaligned teeth, which can affect their bite and lead to dental problems later. Insurance can assist in covering orthodontic treatments such as braces.

- Gum Disease: Children can also suffer from gingivitis and other forms of gum disease, which can affect their overall health. Regular cleanings covered by insurance can help prevent this.

- Dental Trauma: Accidents can lead to chipped or knocked-out teeth, particularly in active children. Dental coverage can alleviate the financial burden of emergency dental services.

Access to insurance enables families to prioritize dental visits and preventive care, ensuring children grow up with healthy smiles. Regular check-ups and treatments can instill a sense of responsibility towards oral hygiene, which is vital for lifelong health. As children become accustomed to visiting the dentist, they are more likely to maintain these habits into adulthood, leading to a reduction in dental issues over time.

“Investing in a child’s dental health is investing in their future well-being.”

Types of Dental Insurance Plans for Children

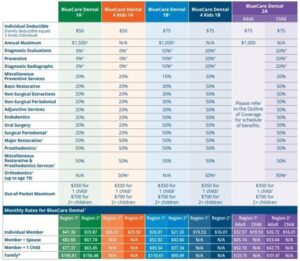

Understanding the different types of dental insurance plans available for children is essential for parents looking to provide their little ones with the best possible oral health care. Each plan comes with its own set of benefits, coverage options, and costs that can significantly impact a family’s budget and choices regarding dental care.Dental insurance plans for children generally fall into three main categories: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and indemnity plans.

Each of these plans has specific features that distinguish them from one another, particularly in terms of coverage, flexibility, and cost.

Health Maintenance Organization (HMO)

HMO dental plans require members to select a primary dentist from a network of providers. This plan type emphasizes preventive care and typically has lower out-of-pocket costs.

- Coverage: HMO plans usually cover preventive services like cleanings and check-ups at little to no cost. However, for other services, referrals to specialists are often required.

- Cost: Monthly premiums are generally lower compared to other plans, making HMO a budget-friendly option for families.

Preferred Provider Organization (PPO)

PPO plans provide more flexibility in choosing dental care providers. While they have a network of preferred dentists, members can also see out-of-network providers at a higher cost.

- Coverage: PPO plans offer a wider range of services and usually cover a larger portion of costs for both preventive and major services.

- Cost: Monthly premiums tend to be higher, but the flexibility to choose providers can make them appealing for families who prefer a more extensive network.

Indemnity Plans

Indemnity plans, often referred to as traditional dental insurance, allow families to visit any dentist without network restrictions, providing maximum flexibility.

- Coverage: These plans typically cover a percentage of the costs for a wide array of dental services, including major procedures, but may require deductibles and co-payments.

- Cost: Indemnity plans usually come with higher premiums and out-of-pocket expenses, making them a more expensive option for families.

The cost of dental insurance options can vary significantly based on the type of plan, the coverage it offers, and the specific needs of the family. For instance, families opting for HMO plans might pay less in monthly premiums but could face additional costs for specialist visits. In contrast, while PPO and indemnity plans might incur higher monthly payments, they generally provide more comprehensive coverage and flexibility in accessing dental services.

“The right dental insurance plan can greatly influence the accessibility and quality of dental care for children, impacting their lifelong oral health.”

Related Insurance Coverage

Dental insurance plays a critical role when paired with health insurance, particularly for families with children. The combined benefits of these insurances ensure comprehensive care, addressing both dental and overall health needs. Understanding the relationship between various insurance types can help families make informed choices about their coverage.

Importance of Dental Insurance with Health Insurance

Integrating dental insurance with health insurance is vital for families, as it promotes a holistic approach to health care. Many health issues, particularly in children, can stem from poor dental hygiene or untreated dental problems. Hospitals and clinics often look for comprehensive coverage when treating patients; therefore, having both insurances can ease financial burdens and streamline care.

“Oral health is an integral part of overall health.”

Families with dental insurance are more likely to schedule regular check-ups and preventative care, leading to healthier outcomes in both dental and medical contexts. This proactive approach not only reduces the risk of severe illnesses but also lowers long-term medical costs, making dental coverage an essential component of family health insurance plans.

Impact of Disability Insurance on Families

Disability insurance can significantly affect families with children requiring dental care. In cases where a parent becomes disabled, the financial strain can hinder their ability to provide necessary dental and health care for their children. This insurance serves as a safety net, allowing families to maintain stability during challenging times.The impact can be seen in the following areas:

- Access to Care: Families may struggle to afford dental visits without adequate income. Disability insurance can help cover these expenses, ensuring children receive necessary treatments.

- Preventive Services: Regular dental check-ups may be neglected due to financial concerns. With disability insurance, families are less likely to skip these essential appointments, promoting better oral health.

- Long-term Benefits: Maintaining dental health can reduce the risk of needing more expensive treatments later, which is crucial for families on a tight budget due to disabilities.

Importance of Flood Insurance in Natural Disaster Areas

For families living in areas prone to natural disasters, flood insurance becomes an essential part of their overall safety net. While it may not seem directly related to dental care, the connection lies in the disruption of health services during and after such events. When flooding occurs, access to health facilities, including dental clinics, can be severely limited.The importance of flood insurance for affected families includes:

- Protection of Property: Flood insurance can safeguard homes, which often contain essential medical supplies and equipment.

- Continuity of Care: With financial assistance from flood insurance, families can relocate temporarily and continue accessing dental services, mitigating potential health issues.

- Community Resources: After a disaster, community health services may become strained. Flood insurance can help families recover financially and maintain access to necessary dental care.

Flood insurance might seem unrelated to dental coverage, but its role in overall health service availability underscores the importance of comprehensive planning for families in vulnerable locations.

Final Summary

In conclusion, investing in dental coverage for children is an essential step toward safeguarding their health and future. By understanding the various insurance options and their benefits, parents can ensure that their kids receive the dental care they need without financial stress. After all, a healthy smile can lead to a lifetime of confidence and well-being.

Helpful Answers

What is the average cost of dental coverage for children?

The average cost can vary widely depending on the plan type and coverage level, typically ranging from $15 to $50 per month per child.

Are dental check-ups covered under children’s dental insurance?

Yes, most dental plans cover regular check-ups and preventive services, often with no out-of-pocket cost.

Can I add my child to my existing dental plan?

In many cases, yes, as long as your plan allows dependent coverage; check with your insurance provider for specific details.

How do I choose the right dental insurance plan for my child?

Consider factors like coverage options, the network of dentists, costs, and any specific dental needs your child may have.

What happens if my child needs braces? Is that covered?

Many dental plans include orthodontic coverage, but it’s crucial to review your specific plan for details on coverage limits and co-pays.